Hsmb Advisory Llc Fundamentals Explained

Hsmb Advisory Llc Fundamentals Explained

Blog Article

The 4-Minute Rule for Hsmb Advisory Llc

Table of ContentsSome Ideas on Hsmb Advisory Llc You Should KnowThe Definitive Guide for Hsmb Advisory LlcHsmb Advisory Llc for BeginnersSome Known Factual Statements About Hsmb Advisory Llc Some Known Incorrect Statements About Hsmb Advisory Llc Hsmb Advisory Llc for Beginners

Ford states to guide clear of "money value or irreversible" life insurance policy, which is more of an investment than an insurance. "Those are extremely complicated, come with high payments, and 9 out of 10 people don't need them. They're oversold since insurance representatives make the largest commissions on these," he says.:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Special needs insurance coverage can be pricey. And for those who opt for long-lasting care insurance coverage, this policy may make disability insurance policy unnecessary.

The Only Guide to Hsmb Advisory Llc

If you have a chronic wellness problem, this type of insurance might end up being important (Insurance Advisors). Do not let it stress you or your bank account early in lifeit's normally best to take out a plan in your 50s or 60s with the expectancy that you will not be using it until your 70s or later on.

If you're a small-business proprietor, consider shielding your source of income by buying company insurance coverage. In the event of a disaster-related closure or period of rebuilding, company insurance can cover your earnings loss. Think about if a substantial weather occasion affected your storefront or manufacturing facilityhow would that affect your earnings?

Plus, making use of insurance policy might occasionally set you back greater than it conserves over time. For example, if you obtain a contribute your windscreen, you may take into consideration covering the repair work expense with your emergency cost savings rather of your automobile insurance policy. Why? Since utilizing your vehicle insurance can create your monthly costs to rise.

The Best Strategy To Use For Hsmb Advisory Llc

Share these suggestions to secure loved ones from being both underinsured and overinsuredand speak with a trusted specialist when needed. (https://hearthis.at/hsmbadvisory/set/hsmb-advisory-llc/)

Insurance coverage that is purchased by an individual for single-person protection or protection of a household. The specific pays the premium, as opposed to employer-based medical insurance where the company often pays a share of the costs. Individuals might look for and acquisition insurance from any type of strategies offered in the individual's geographic area.

People and families might get economic aid to decrease the expense of insurance coverage premiums and out-of-pocket prices, however only when signing up through Attach Continued for Wellness Colorado. If you experience certain modifications in your life,, you are eligible for a 60-day period of time where you can sign up in an individual plan, even if it is beyond the annual open registration duration of Nov.

What Does Hsmb Advisory Llc Mean?

- Attach for Health And Wellness Colorado has a complete checklist of these Qualifying Life Events. Dependent kids who are under age 26 are qualified to be included as household participants under a parent's protection.

It may appear straightforward however recognizing insurance policy kinds can additionally be perplexing. Much of this complication originates from the insurance sector's continuous objective to make individualized protection for insurance holders. In developing flexible policies, there are a variety to choose fromand every one of those insurance types can make it challenging to recognize what a specific plan is and does.How Hsmb Advisory Llc can Save You Time, Stress, and Money.

If you pass away throughout this period, the person or people you've named as beneficiaries might obtain the money payout of the policy.

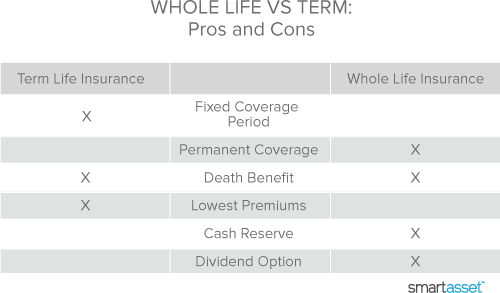

Lots of term life insurance coverage plans let you transform them to a whole life insurance plan, so you don't shed coverage. Usually, term life insurance policy plan premium payments (what you pay per month or year right into your policy) are not secured in at the time of purchase, so every 5 or 10 years you have the plan, your costs might climb.

They additionally often tend to be less costly total than whole life, unless you acquire an entire life insurance plan when you're young. There are also a couple of variants on term life insurance. One, called group term life insurance policy, is usual amongst insurance coverage choices you could have accessibility to through your employer.The Facts About Hsmb Advisory Llc Revealed

This is generally done at no charge to the worker, with the capability to purchase added protection that's obtained of the worker's paycheck. One more variant that you may have access to via your employer is extra life insurance policy (Life Insurance). Supplemental life insurance policy might consist of unintentional fatality and dismemberment (AD&D) insurance policy, or interment insuranceadditional coverage that could assist your household in case something unanticipated happens to you.

Irreversible life insurance policy just refers to any type of life insurance policy policy that doesn't end. There are numerous sorts of long-term life insurancethe most usual kinds being entire life insurance policy and universal life insurance policy. Whole life insurance policy is specifically what it seems like: life insurance for your entire life that pays out to your beneficiaries when you pass away.

Report this page